Accounting transactions can get entered incorrectly into an accounting system, or maybe a transaction should have been split into two different general ledger accounts.

Either way, when this happens you must make changes to your original transaction after it's been recorded, and you can do this easily in QuickBooks accounting software by making a journal entry.

You can make journal entries in QuickBooks to adjust or correct transactions and post entries that cannot be performed in other ways, such as adjustments to profit or loss. The journal entry process is simple.

Things you should know before you create a Journal Entry

A general journal entry is an accounting transaction that is entered, or posted, directly to the general ledger. A company's general ledger acts as its main group of accounts used to record balance sheet and income statement transactions.

Typical journal entries for QuickBooks include booking depreciation entries, income tax provisions, and loan interest adjustments. If a journal entry is in fact needed, consider the following rules:

- Only one Accounts Receivable or Accounts Payable type account per entry.

- On the journal entry itself, use the Accounts Receivable or Accounts Payable account on the second line of the journal entry so that it properly posts.

- Any entry to an Accounts Receivable or Accounts Payable type account will require a customer or vendor, respectively.

- All journal entries are cash basis, regardless of the accounts affected based on where the Accounts Receivable and Accounts Payable accounts are placed in the journal entry.

- Journal entries should not be made to inventory or payroll accounts without a clear understanding of accounting or on the advice of your accountant.

- Entries can be made to correct class entries by choosing the same account for the debit and credit and only making the class designation different. This will re-allocate between classes, while leaving the General Ledger account the same.

- As each journal entry is saved, the General Ledger is automatically updated.

- To create a report of just the journal entries, filter the Transaction Detail by Account report or the Audit Trail report for the transaction type of journal. If only the accountant journal entries are to be printed, choose the entered/modified date from the point that the financial statement reconciliation work began to the current date.

Fishbowl Inventory is a leading warehouse and manufacturing inventory software and a QuickBooks Solution Provider with the capabilities to streamline your inventory and accounting needs. Contact us today to learn more.

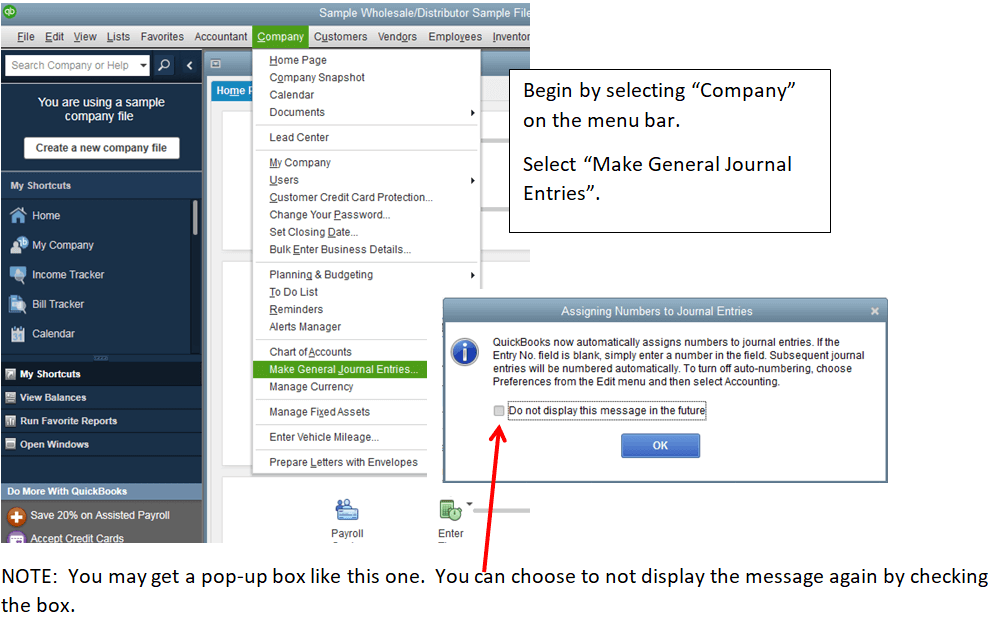

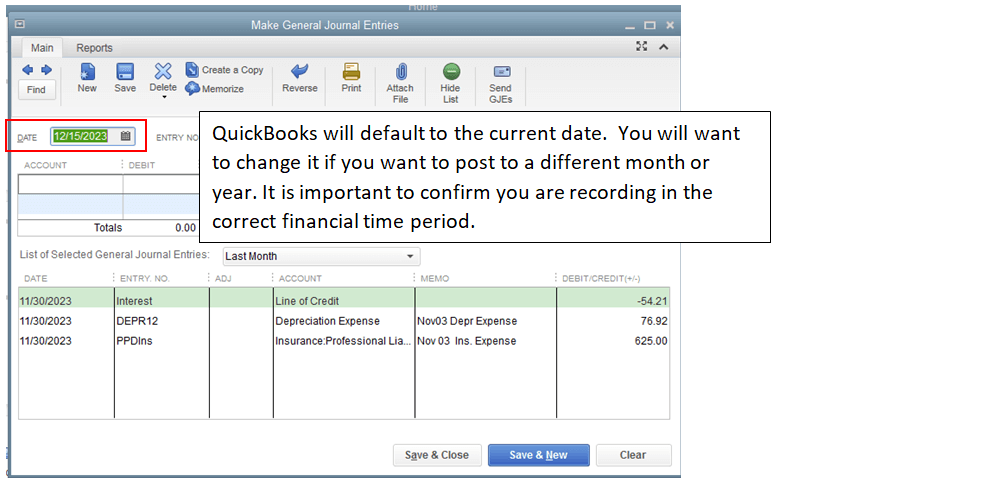

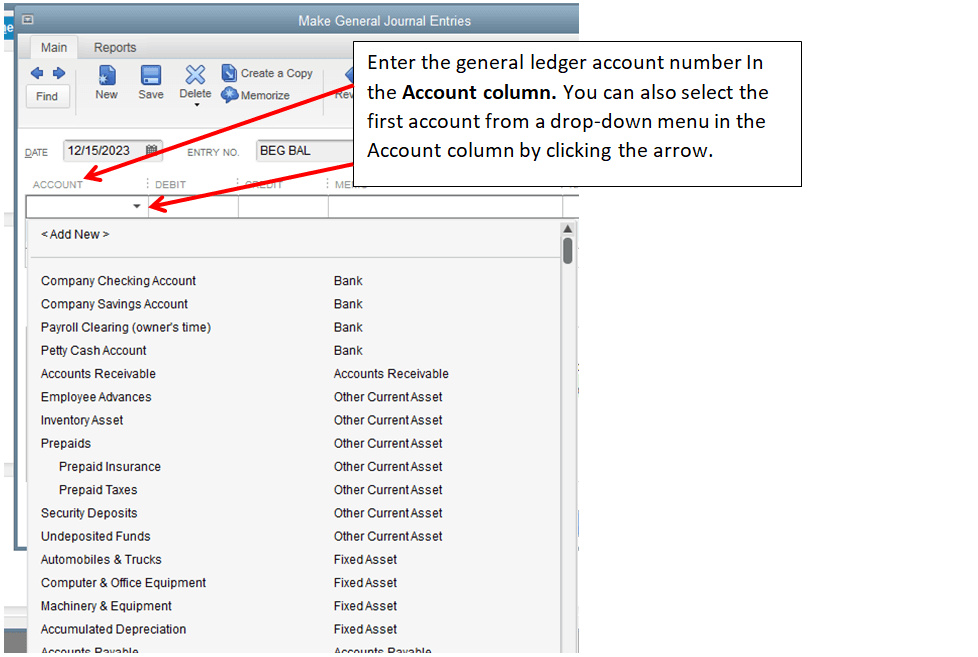

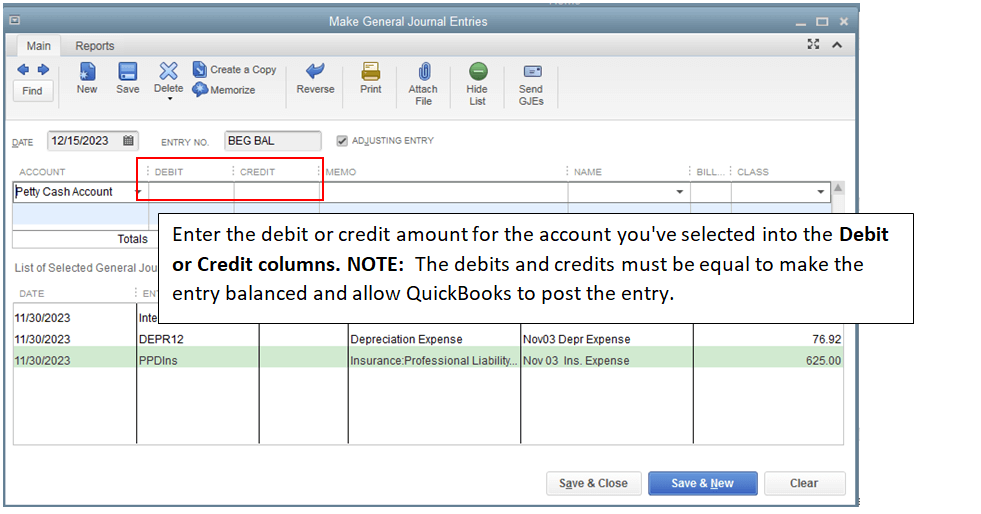

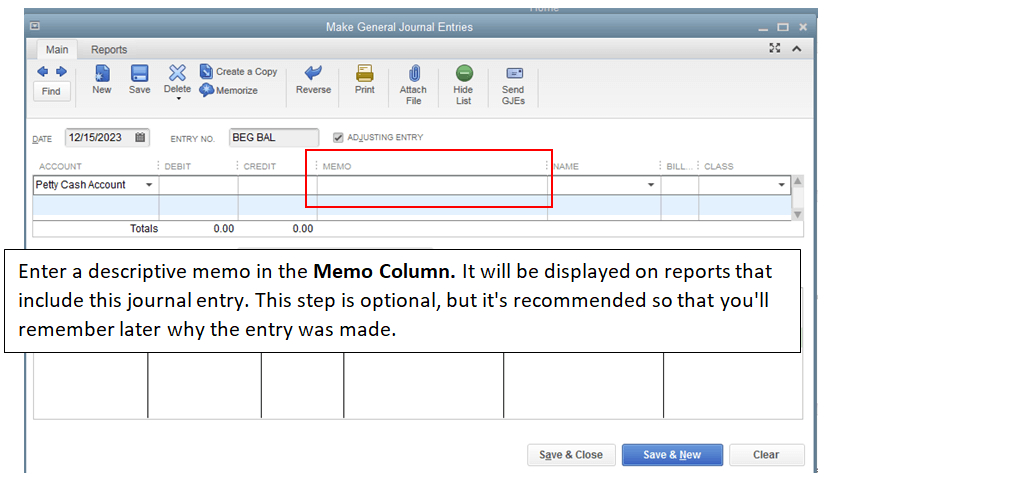

How to Make General Journal Entries in QuickBooks Desktop

Repeat Steps 4 through 6 until the entries completely offset each other and the transaction reaches a zero balance. Your total in the Debit column should equal the total in the Credit column, and the journal entry will then be properly balanced.

Click Save & Close to save the journal entry and close the window or click Save & New to save the journal entry and open a new window.

Need help? Contact us to learn more about our QuickBooks training services.

Author: Beverly Lang, Diversified Business Solutions.